What is zkSNARKs: Spooky Moon Math

What is zkSNARKs: Spooky Moon Math. With Ethereum entering the Metropolis phase, it is going to introduce various changes which are going to make it more abstraction and privacy friendly. One of those changes is the introduction of “Zero-Knowledge Succinct Non-Interactive Argument of Knowledge” aka Zk-Snarks. Zk-Snarks runs on the idea of zero knowledge proofs.

In this article, we are going to go through the idea of zero knowledge proofs and its application in the blockchain technology.

What is zkSNARKs: Spooky Moon Math

Zero Knowledge proofs came about in 1980’s thanks to the work of MIT researchers Shafi Goldwasser, Silvio Micali and Charles Rackoff. They were working on problems related to interactive proof systems, where a Prover exchanges messages with a Verifier (more on provers and verifiers later) to convince them that they have a knowledge of a certain proof without declaring what that knowledge is.

Before they made their landmark discovery, most proof systems were based on the “soundness” properties of the proof system. It was always assumed that the “prover” could be the malicious one in any scenario wherein they will try to fool the verifier. These 3 researchers flipped the idea on its head by questioning the morality of the verifier instead of the prover. The question they asked was, how can anyone know for sure that the verifier won’t leak the knowledge and there were also concerns raised as to the amount of knowledge about the prover that the verifier will get to know during the process of verification.

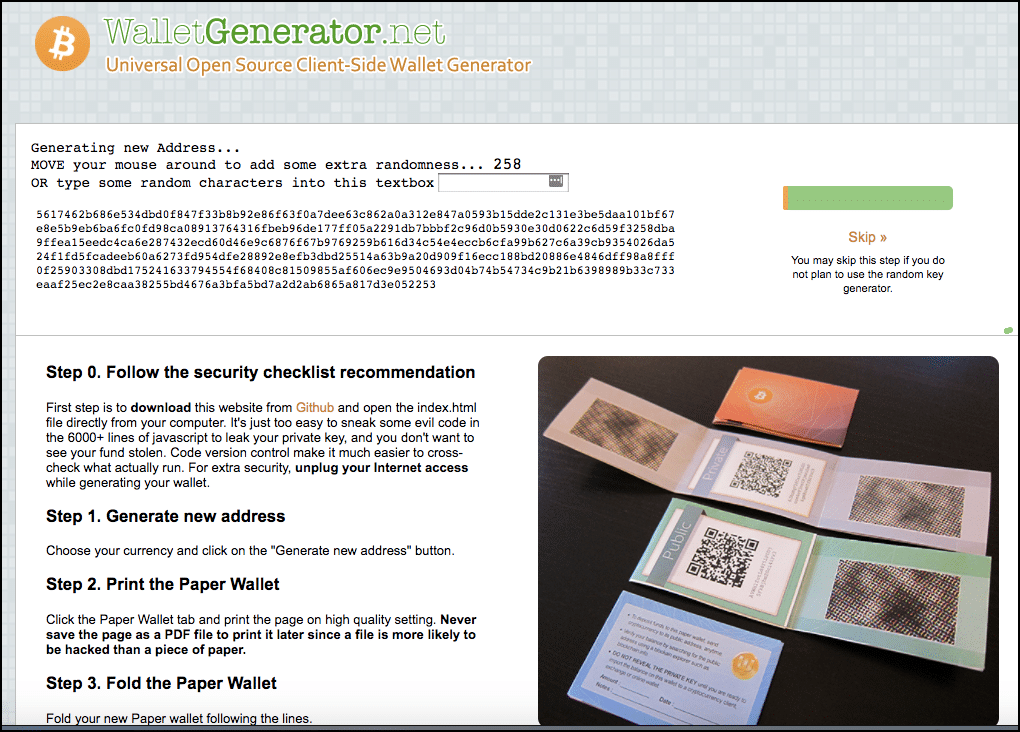

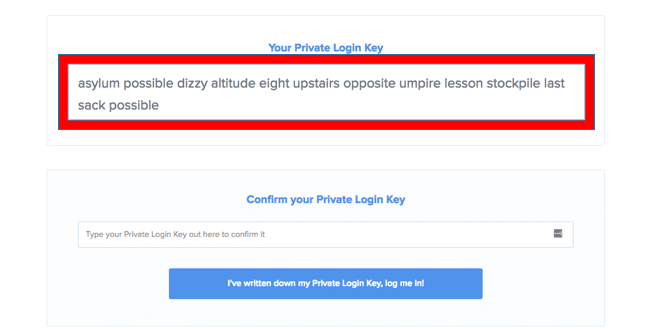

There are various real world consequences of this conundrum and one of the most famous ones have to do with password protection. Suppose you want to login to a website using a password. The standard protocol is that the client (you) will write in their password and send it to the server, the server will then hash the password and equate it to the hash that they have stored in their system. If the values match up, then you can enter the system.

Can you see the huge flaw in this system right?

The server has the plaintext version of your password, and your privacy is at the mercy of the server (the verifier in this scenario). If the server gets compromised or attacked, then your password will be with the malicious party and the consequences could be dire. In order to counter these scenarios, zero knowledge proofs are absolutely essential and path breaking in every sense.

There are two parties when it comes to a zero knowledge proof (as stated above), the prover and the verifier. Zero knowledge states that a prover can prove to the verifier that they possess a certain knowledge without telling them what that knowledge actually is

Properties of a zero knowledge proof

For a ZKP to work it needs to satisfy certain parameters:

- Completeness: If the statement is true then an honest verifier can be convinced of it by an honest prover.

- Soundness: If the prover is dishonest, they can’t convince the verifier of the soundness of the statement by lying.

- Zero-Knowledge: If the statement is true, the verifier will have no idea what the statement actually is.

So now that we have a basic idea of what a zero-knowledge proof is, let’s check out some examples of it before we dive deep into zk-snarks and its application in the blockchain.

Case #1 Alibaba’s Cave

In this example, the prover (P) is saying to the verifier(V) that they know the password of the secret door at the back of the cave and they want to prove it to the verifier without actually telling them the password.

So this is what it looks like:

Image courtesy: Scott Twombly (YouTube channel)

The Prover goes down any of the paths A and B, suppose they initially decide to go through path A and reach the secret door at the back. When they do so, the verifier V comes in at the entrance, with no knowledge of which path the prover actually took and declares that they want to see the prover appear from path B.

In the diagram, as you can see, the prover does indeed appear in path B. But what if this was dumb luck? What if the prover didn’t know the pass code, and took the path B, was stuck at the door and by sheer fortune, the verifier told him to appear from path B, the one they were originally on anyway?

So, to test the validity, the experiment is done multiple times. If the prover can appear at the correct path every single time, it proves to the verifier that the prover indeed knows the password even though the verifier doesn’t know what the password actually is.

Let’s see how the three properties of zero knowledge are satisfied in this example:

- Completeness: Since the statement was true, the honest prover convinced the honest verifier.

- Soundness: If the prover was dishonest, they couldn’t have fooled the verifier because the test was done multiple times. Eventually, the prover’s luck had to run out.

- Zero-Knowledge: The verifier never knew what the password was, but was convinced that the prover had possession of it.

Case #2 Finding Waldo

Remember finding Waldo?

Of course, you do, you must have seen it somewhere, either in real life or online. For those who don’t know, Finding Waldo is a game where you have to find “Waldo” among a sea of people. It is a simple “Spot the guy” game. Just to give you a basic idea, this is what the game looks like:

Image courtesy: Youtube (IntoConnection)

And the idea is to find Waldo who looks like this:

Image courtesy: Pinterest

Seems pretty straightforward right? Find this guy among the sea of other people that you see in the game. Ok, so where does the concept of Zero Knowledge come in here? Imagine there are two people Anna and Carl. Anna tells Carl that she knows where Wally is but she doesn’t want to show him where exactly he is. So, how can she prove to him that she has found Wally without showing his exact position?

There was, an interesting paper by Naor, Naor and Reingold which shows two Zero Knowledge solutions to this problem. There is a “Mid-Tech Solution” and a “Low-Tech Solution”. Let’s discuss both of them.

Mid-Tech Solution

The reason why this solution is “mid-tech” is because our prover and verifier need access to a photocopy machine to make this work. So this is how it goes. First, Anna and Carl would make a photocopy of the original game. Then Anna, whilst making sure that Carl isn’t looking, will cut out Waldo from the photocopy and then destroy the leftovers. After that she can show the Waldo cut out to Carl and prove that she did know where Waldo was after all without pinpointing his exact location to Carl.

There are problems with this solution. While it does fulfill the “Zero Knowledge” criteria, it doesn’t fulfill the “Soundness” criteria. There are many ways that Anna could have cheated here. She could have had a random Waldo cut out with her from the very beginning and could have just shown it to Carl without actually knowing where Waldo was. So what is the solution to this?

The solution to this is meticulous and careful testing. Firstly, Anna and Carl will take a photocopy of the game. Then Carl will draw a distinctive pattern at the back of the photocopy. After that, Carl will escort Anna to a room where she will be isolated and have no chance of cheating whatsoever. If Anna comes out with a cutout of Waldo, then Carl can be convinced that she actually knew where Waldo was without revealing the solution. They can repeat this experiment multiple times and Carl can compare the different cutouts of Waldo to be even further sure about the validity of Anna’s claim.

Low-Tech Solution

This solution required very basic equipment. The idea is simple. Get a huge cardboard, one that is twice the size of the game and cut out a small rectangle on it. Now, when Carl isn’t looking, Anna can move the cardboard on the game in such a way that the rectangle is directly on top of Waldo. Now, she can tell Carl to have a look and this is what he will see:

Image Courtesy: Applied Kid Cryptography by Naor And Reingold

So, while Carl may get a very basic idea of where Waldo actually can be, he doesn’t know the exact location. Anna has hence proved to Carl that she knows where Waldo is without pinpointing his exact location.

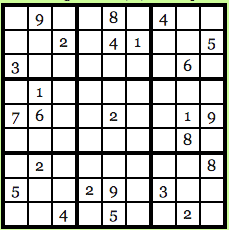

Case #3: Sudoku

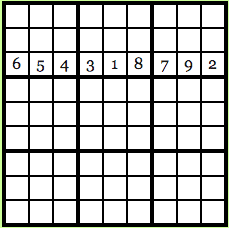

Another great application of zero knowledge is in Sudoku. For those who don’t know, Sudoku is a Japanese puzzle where you get a 9X9 table which looks something like this:

Image courtesy: Computational Complexity Blog.

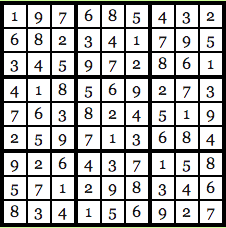

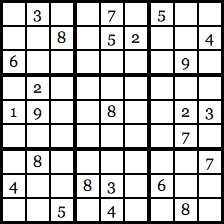

The idea is to fill up every row, every column and every 3X3 block with numbers from 1-9 and no number should repeat itself. So, the solution for the puzzle above looks like this:

Image courtesy: Computational Complexity Blog.

As you can see, every row, column, and 3X3 block are unique and not a single number has been repeated. Let’s go back to our old friends Anna and Carl. Anna has found the solution to the Sudoku puzzle and Carl, skeptic that he is doesn’t believe her and wants Anna to prove that she does indeed know the solution. Anna wants to prove her honesty, but at the same time, she doesn’t want Carl to know the exact solution of the puzzle. How will she go about it? Anna is going to use Zero Knowledge to prove the validity of her claim.

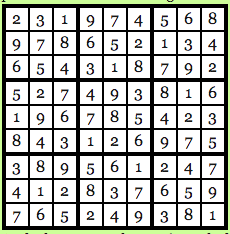

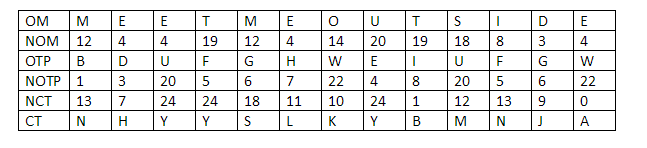

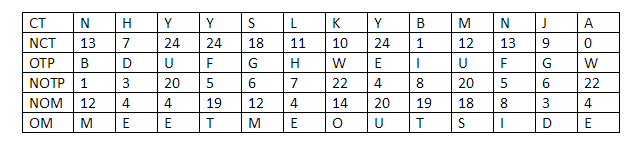

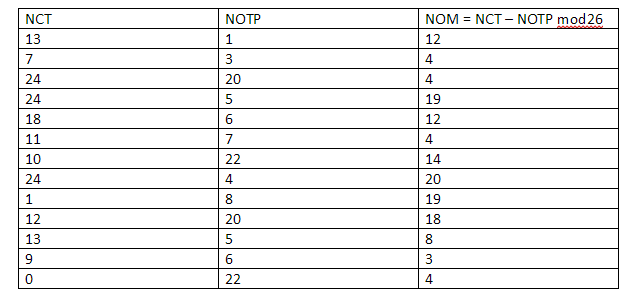

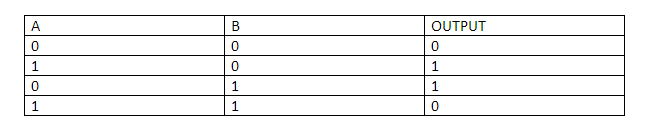

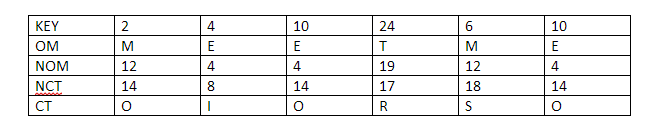

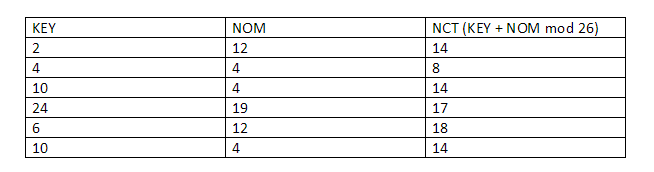

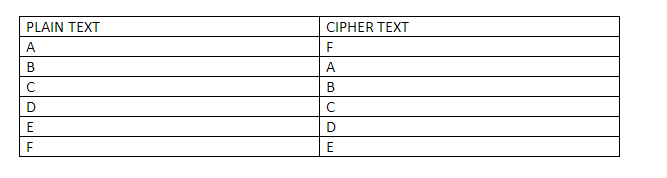

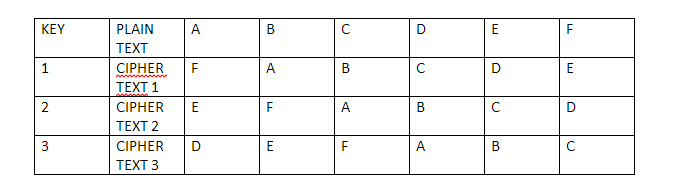

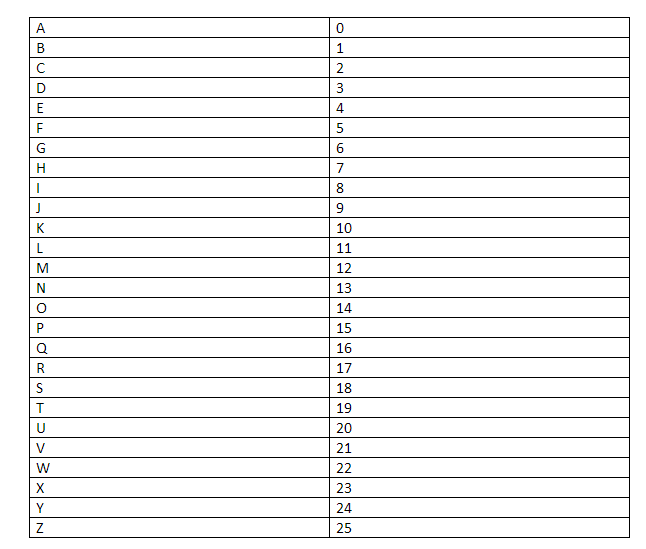

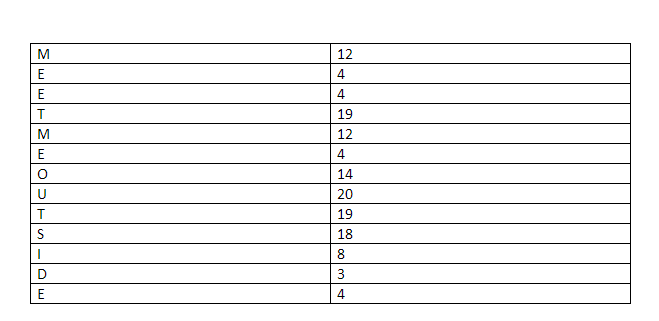

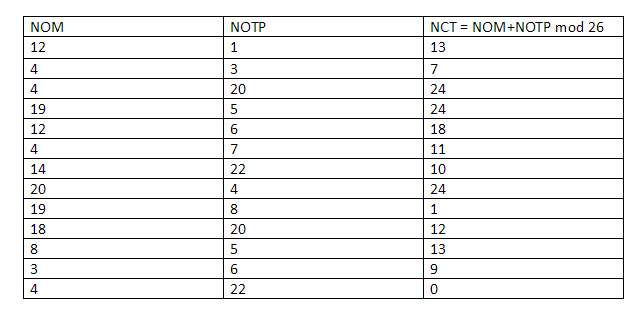

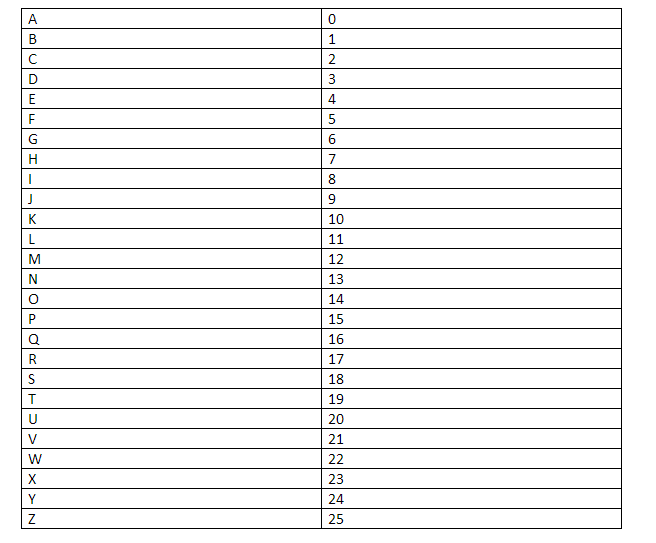

Firstly, Carl will run the Sudoku solution through a computer program which has been verified, to be honest and the program will run the numbers through a randomly chosen substitution cipher. Say, for this particular problem the cipher that the program has chosen is this:

The chosen program and cipher is such that each digit has the same chance of being transmuted into its substitution as any other number. Basically, 1 has as much chance of being transmuted as 3 and 4 have as much chance of being transmuted as 9 and so on and so forth. So, using this cipher gives us the following solution to the puzzle above:

Image courtesy: Computational Complexity Blog.

Anna gets the transmuted solution now, keep in mind that Carl still doesn’t know what the original solution was and he doesn’t possess the transmuted solution either. So, what Anna does now is that she hides all the numbers in the puzzle by using a “lockbox mechanism”, basically Carl won’t be able to see any of the numbers and will see an empty 9X9 grid in front of him.

Carl now has 28 choices in front of him:

- Reveal a row.

- Reveal a column.

- Reveal a 3X3 box.

- Reveal the transmuted version of the original puzzle.

Suppose Carl wants to know what the third row looks like:

Image courtesy: Computational Complexity Blog.

This is what he will see. Carl will see that every number in the row is unique and since every possible number in the original solution had the same probability of being transmuted via the cipher, Carl will have no clue as to what the original solution is.

Now suppose, Carl decides to take the last option and wants to see what the original puzzle in looks like when transmuted:

Image courtesy: Computational Complexity Blog.

Once again, since the cipher was chosen at random and all the numbers have the same probability of being transmuted, Carl will have no idea what the original solution is. Carl can now go through all 28 of his choices and eventually he will be satisfied with the validity of Anna’s statement.

Why?

Because, if Anna was indeed cheating, there is no way that she could have found a cipher to give unique solutions for all 28 of Carl’s choices. If Carl just chose one option, Anna’s chances of getting away with cheating are 27/28. BUT if Carl chose to do random test multiple times, suppose he chooses to test it 150 times, Anna’s choice of getting away with cheating drops down to (27/28) ^150 which is < 0.5%.

So, let’s check out the zero knowledge properties of this scenario:

- Completeness: The cipher program being used has been verified, to be honest, and both Anna and Carl are following protocol.

- Soundness: If Carl does random tests 150 times, Anna’s chances of getting away with cheating is < 0.5%.

- Zero-Knowledge: Anna never had to reveal to Carl what the original solution was.

Proof vs Proof Of Statements

Now that we know the theoretical aspects of zero knowledge proofs and its application in various examples, what is its practical application in blockchain? Why is everyone raving about Zcash for implementing ZKP (zero knowledge proofs) and why is everyone excited about Ethereum doing the same? Before we expand on that, it is important to know one more important theoretical concept.

What exactly are we proving by using ZKP? In a broad spectrum, there are two statements that you can prove by using ZKP. Proofs aka facts and proof of knowledge.

- Proofs: These are the intrinsic truths about the universe that you may want to prove via ZKP. Eg. “number X belongs to a group Y”.

- Proof of knowledge: You may also want to prove that you have knowledge of a particular idea without revealing what that particular knowledge is. As can be seen in the examples of Sudoku, Waldo and Alibaba’s cave given above.

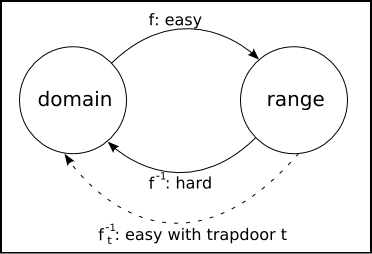

It is important to note the difference between these two because they are completely different. In the cryptocurrency world, we are mostly focused around “proof of knowledge”. One of the most important breakthroughs in proving proof of knowledge via zero knowledge proof came when Claus-Peter Schnorr in the 1980s came up with the Schnorr identification protocol. This protocol lays the basics of modern key signature cryptography and displays how Zero-knowledge can be seamlessly integrated into modern cryptographical practices.

The Schnorr Identification Protocol

To understand what the Schnorr Identification is about let’s bring back our old friends Anna and Carl. Anna has announced to the world that she has a public key and can accept and receive information through it. Carl, always the skeptic, thinks that Anna is lying. The only way that Anna can prove her honesty is by showing her private key to Carl, but she doesn’t want to reveal her private key.

So, how will Anna reveal her knowledge of her private key without revealing it? This is where the Schnorr protocol comes in. Before we even begin to understand how the protocol works, there are certain parameters that you need to know:

- p = Any prime number.

- q= factor of p-1.

- “a” such that a^q = 1 mod p.

Now keep in mind, in the Schnorr protocol, these 3 variables are global. Meaning anyone has knowledge of what these 3 variables for a particular scenario are.

Now we come to the two keys, the secret private key that we will call “s” and the public key that we will call “v”.

s can be any value as long as 0<s<q.

v = a^-s mod q.

The public key “v” will be global and public knowledge along with p,q and a. However, ONLY Anna will have the knowledge of what “s” is, because that is her private key.

So, now that we have defined the variable, let’s see how the information exchange and the validity of Anna’s statement can work WITHOUT her revealing what the private key is.

Anna signs and sends an encrypted message

Suppose Anna wants to send a message “M” to Carl encoded with her private key. How will she do it if she were to follow Schnorr’s protocol?

Firstly, she will choose a random number “r” such that 0<r<q.

Now she will compute a value x such that:

X= a^r mod p.

Now that she has computed the value of X, she is going concatenate this with the original message. What is concatenation? Suppose we have two strings “hello” and “world”. If we concatenate these two, then we will get “hello world”. Concatenation basically means adding two strings and making it one.

So, she is going to concatenate M and X to get M||X. and she is going to store the hash of this value in e.

Basically, e = H(M||X) where H() is the hash function.

Finally, when all this is done, she will do one final computation. She is going to get a value “y” such that:

y = (r + s*e) mod q

Now that all the computations are over, she is going to send the following pieces of information to Carl:

- The message “M”.

- The signatures e and y.

Carl receives the message and verifies Anna’s proof of knowledge

Now Carl has received the following pieces of information from Anna: The message (M) and the signatures (e and y).

Along with that, he has the following pieces of information that is known publicly to everyone:

- Anna’s public key “v”.

- The prime number that Anna chose “p”.

- “q” which is the factor of “p-1” which Anna chose.

- And the “a” such that a^q = 1 mod p, this also Anna chose.

Now, Carl will have to compute X’ such that:

X’ = a^y * v^e mod p.

Now let’s do some simple substitution:

We know that v = a^-s, let’s substitute that in the equation above and we get:

- X’ = a^y * a^-se = a ^ (y-s*e).

- Now we also know that y = r + s*e.

- Which means: r = y-s*e.

Let’s substitute this value in the equation above:

- We get: X’ = a^r.

- As we have already seen above: X= a^r.

- So technically: X = X’.

But Carl doesn’t know the value of “X” because he never received that value. All that he received are the following: The message M, the signatures (e and y) and the host of public variables (public key “v”, p ,q, and a).

He never received “X” but he knows that if Anna is speaking the truth then X’ has to be equal to X.

But, he does know the value of e and the message M.

So he is going to solve for e by doing the following:

e = H ( M||X’).

Note that earlier we solved for e by doing: H(M||X).

So, by that logic, if the two values of e come up to be the same then that means X = X’.

This also means that Anna did indeed have the private key all along and she was not lying.

So, let’s run this entire scenario through the three properties of zero knowledge proofs:

- Completeness: Carl was convinced of Anna’s honesty because at the end X = X’.

- Soundness: The plan was sound because the only way Anna could have proved her honesty was by using her private key. She couldn’t have lied about having the private key.

- Zero Knowledge: Carl never found out what Anna’s private key was.

Schnorr’s protocol gives a very real world cryptographical application of zero knowledge proofs.

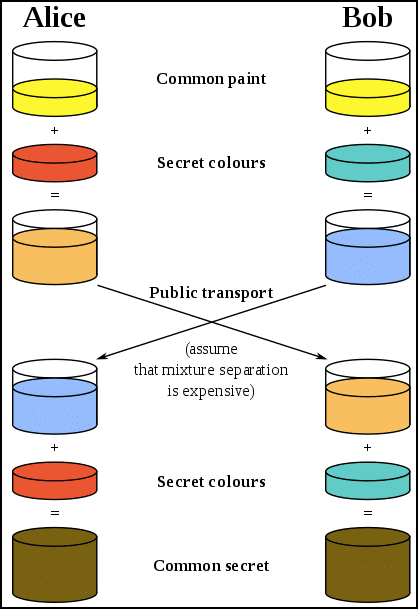

How to make zero knowledge proofs non-interactive?

With earlier zero-knowledge verification systems there was one big problem. For it to work, the prover and the verifier had to be online at the same time. In other words, the process was “interactive”. This made the entire system inefficient and almost impossible to scale up. The verifiers couldn’t possibly be online at the same time as provers all the time? There needed to be a system to make this more efficient.

In 1986, Fiat and Shamir invented the Fiat-Shamir heuristic and successfully changed the interactive zero-knowledge proof to non-interactive zero knowledge proof. This helped the entire protocol work without any interaction. The procedure behind it is very simple.

So, to give you an example, this is how zero knowledge proofs used to work before Fiat and Shamir.

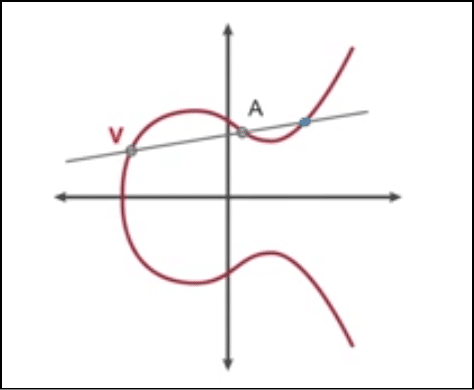

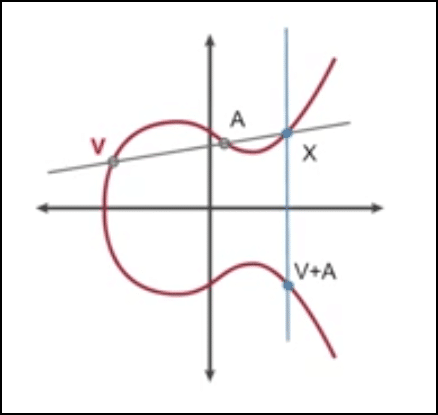

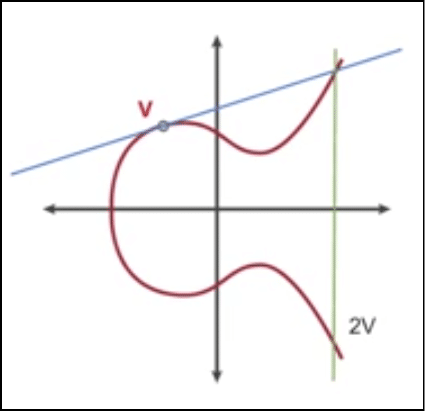

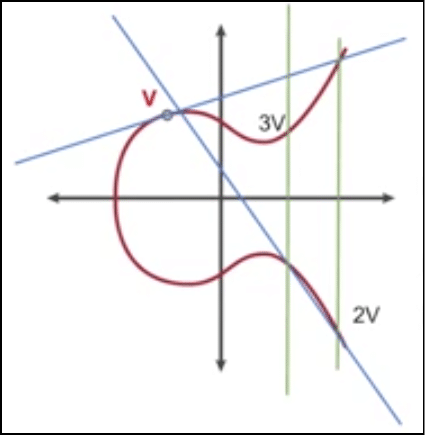

Let’s prove this using simple discrete logarithms.

- Anna wants to prove to Carl that she knows a value x such that y = g^x to a base g.

- Anna picks a random value v from a set of values Z, and computes t = g^v and sends t to Carl.

- Carl picks a random value c from the set Z and sends it to Anna.

- Anna computes r = v-c*x and returns r to Carl.

- Carl checks if t= g^r * y^c holds or not ( since r= v-c*x, y= g^x and by simple substitution, g^(v-c*x)* g ^ c*x = g^v = t).

- Carl doesn’t know the value of x, by merely checking if t = g^r * y^c he can verify that Anna does indeed know the value of x.

Now while the above interaction is zero-knowledge, the problem with this is that Anna and Carl need to be online and exchanging values for it to work.

How can Anna prove to Carl that she has knowledge of something without Carl being online? She can do so by using a simple cryptographic hash function, as Fiat and Shamir theorized.

Let’s look how the example above would work in a non-interactive way:

- Anna wants to prove to Carl that she knows a value x such that y = g^x to a base g.

- Anna picks a random value v from a set of values Z, and computes t = g^v.

- Anna computes c = H(g,y,t) where H() is a hash function.

- Anna computes r = v – c*x.

- Carl or anyone can then check if t = g^r * y^c.

So, as you can see, zero knowledge proofs were made noninteractive. And this was what laid the foundations for Zk-Snarks.

What is the use of Zk-Snarks?

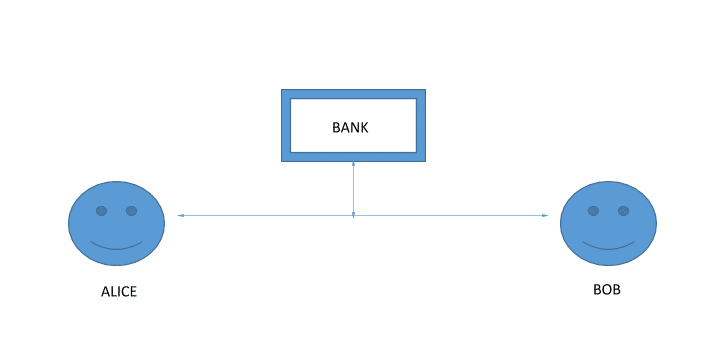

Zk-Snarks stands for “Zero-Knowledge Succinct Non-Interactive Argument of Knowledge”. Its use in modern blockchain technology is immense. To understand its application, it is important to know how a smart contract works. A smart contract is basically an escrow of funds which gets activated once a particular function is done.

Eg. Anna puts 100 ETH in a smart contract that she gets into with Carl. Carl has to do a particular task, on the completion of which, Carl will get the 100 ETH from the smart contract.

This gets complicated when the tasks that Carl has to do are multi layered and confidential. Suppose you have entered a smart contract with Anna. Now, you will only get the payment if you do A, B and C. What if you don’t want to reveal the details of A, B, and C because they are confidential to your company and you don’t want any competitors to know what you have to do?

What Zk-Snarks does is that it proves that those steps have been taken in the smart contract without revealing what those steps actually are. It is very useful is protecting you and your company’s privacy. It can just reveal part of the process without showing the whole process itself and prove that you are being honest about your claims.

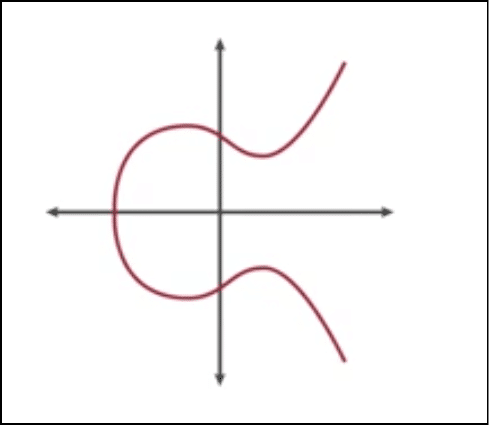

How do ZkSnarks work?

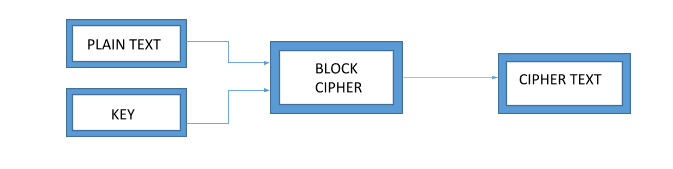

A Zk-Snark consists of 3 algorithms: G, P and V.

G is a key generator takes an input “lambda” (which must be kept confidential and shouldn’t be revealed under any circumstances) and a program C. It then proceeds to generate two publicly available keys, a proving key pk, and a verification key vk. These keys are both public and available to any of the concerned parties.

P is the prover who is going to use 3 items as input. The proving key pk, the random input x, which is publicly available, and the private statement that they want to prove the knowledge of without revealing what it actually is. Let’s call that private statement “w”. The P algorithm generates a proof prf such that: prf = P(pk, x,w).

The verifier algorithm V has basically returned a boolean variable. A Boolean variable has only two choices, it can be TRUE or it can be FALSE. So, the verifier takes in the verifying key, public input x and proof prf as input such as:

V(vk,x,prf)

..and returns TRUE if the prover is correct and false otherwise.

Now, about the parameter lambda. The value of the “Lambda” must be kept confidential because then anyone can use it to generate fake proofs. These fake proofs will return a value of TRUE regardless of whether the prover actually has knowledge of private statement “w” or not.

Functionality of ZkSnarks

For showing the functionality of a Zk-Snark we are going to use the same example function that Christian Lundkvist used in his article for Consensys. This is what the example program looks like:

function C(x, w)

{

return ( sha256(w) == x );

}

Basically, the function C takes in 2 values as input, a public hash value “x” and the secret statement that needs to be verified “w”. If the SHA-256 hash value of w equals “x” then the function returns TRUE otherwise it returns FALSE. (SHA-256 is the hash function that is used in Bitcoin).

Let’s bring back our old friends Anna and Carl for this example. Anna being the prover and Carl the skeptic is the verifier.

The first thing that Carl, as the verifier, has to do is to generate the proving and verifying key using the generator G. For this, Carl needs to generate the random value “lambda”. As stated above, however, he needs to be super careful with Lambda because he can’t let Anna know its value to stop her from creating fake proofs.

Anyway, this is what that will look like:

G(C, lambda) = (pk , vk).

Now that the two keys are generated, Anna needs to prove the validity of the statement by generating the proof. She is going to generate the proof using the proving algorithm P. She is going to prove that she knows the secret value “w” which hashes (on parsing through SHA-256) to give the output x. So, the proving algorithm for proof generation looks like this:

prf = P( pk, x, w).

Now that she has generated the proof “prf”, she is going to give the value to Carl who is finally going to run the verification algorithm of Zk-Snarks.

This is what that will look like:

V( vk, x, prf).

Here, vk is the verifying key and x is the known hash value and prf is the proof that he has gotten from Anna. If this algorithm returns TRUE then this means that Anna was honest and she indeed had the secret value “w”. If it returns FALSE then this means that Anna was lying about knowing what “w” is.

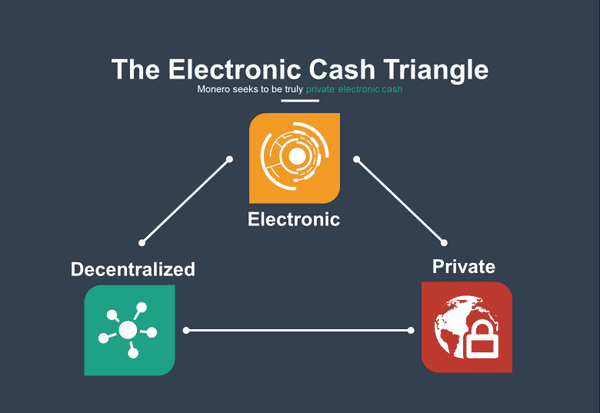

The use of ZkSnarks in cryptocurrency

Image Courtesy: Zcash

Zcash is a cryptocurrency launched by Zerocoin Electic Coin Company on 9th September 2016 and is the first example a cryptocurrency marrying the concepts of blockchain technology with ZkSnarks. It aims to provide completely safe and shielded transaction spaces for its users without revealing details (such as their addresses) to anyone.

Ethereum wants to integrate ZkSnarks as it enters its Metropolis phase and the way that they are planning to do so is by creating an alliance with Zcash which will include the mutual exchange of value. The chief developer of Zcash, Zooko Wilcox, gave a presentation in DevCon2 in Shanghai which explored the future of such an alliance. According to him, there are 3 ways that Z-Cash and by extension, zk-snarks could be integrated with Ethereum.

First method is called Baby Zoe (Zoe = Zcash on Ethereum). It adds a zk-snark pre-compiler on Ethereum and makes a mini Zcash smart contract on Ethereum. The idea is to see whether the Ethereum system can create a zk-snark enabled DAPP on top of its blockchain.

The Second method is to integrate the Ethereum computability inside the Zcash blockchain. As Wilcox puts is, the greatest asset of Ethereum is its computability and people want to see whether they can integrate it on a zk-snark based blockchain like Zcash. Can people create DAPPS on a blockchain made on zero knowledge proofs? That is something that they are waiting to see.

The third and the most exciting aspect is Project Alchemy. This is basically the connection and interoperation of the two blockchains such that one can seamlessly move between the two. The way that Zcash plans to do that is by cloning the BTC Relay. It is an Ethereum script which was written to create a Bitcoin light client inside Ethereum. The Zcash clone will use the same concept to create a Zcash light client inside Ethereum.

If this works then we will have the first, decentralized currency system in the world which facilitates the creation of DAPPS with zero knowledge ingrained in it.

Looking Ahead

There is no doubt that the introduction of zero knowledge proofs is going to be a huge game changer for Ethereum. In an increasingly open, connected and supervised world, any sort of privacy is welcome. How the integration happens remains to be seen, but going by the theoretical concepts itself, one can’t help but get excited.

What is Cryptoeconomics? The Ultimate Beginners Guide

What is cryptoeconomics? Ethereum developer Vlad Zamfir says that cryptoeconomics is:

“A formal discipline that studies protocols that govern the production, distribution, and consumption of goods and services in a decentralized digital economy. Cryptoeconomics is a practical science that focuses on the design and characterization of these protocols.”

The blockchain technology runs on the principles of cryptoeconomics.

Let’s break it down. Cryptoeconomics comes from two words: Cryptography and Economics. People tend to forget the “economics” part of this equation and that is the part that gives the blockchain its unique capabilities. The blockchain wasn’t the first time that a decentralized peer-to-peer system was used, torrent sites have used it for ages to share files. However, in every sense of the word, it has been a failure.

Why was peer-to-peer file sharing a failure?

In a torrent system, anyone can share their file with a decentralized network. The idea was that people would download them and keep seeding aka sharing the file with the network for others to download. The problem was that this worked on an honor system. If you were downloading a file, then you were expected to seed as well. The problem is that humans are not really the most honorable of creatures and without any economic incentives it made no sense for people to keep seeding a file which took up unnecessary space in their computers.

Satoshi Nakamoto and the blockchain technology

In October 2008, an unknown man/woman/group calling themselves Satoshi Nakomoto released a paper which would lay the foundation for bitcoin. This would shake the online community to its very foundations, for the first time we had a working model for something based in cryptoeconomics. The way it differed from earlier p2p decentralized systems, was that people now actually had an economic incentive to “follow the rules”. But more than that, the true genius of the blockchain technology lied in how it circumvented the Byzantine General’s Problem to create a perfect consensus system (more on that later).

Cryptoeconomic properties of Bitcoin

So what are the properties that a cryptocurrency like Bitcoin has as a result of cryptoeconomics?

Let’s go through them one by and one:

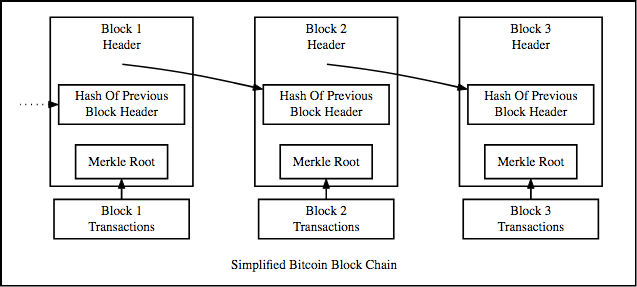

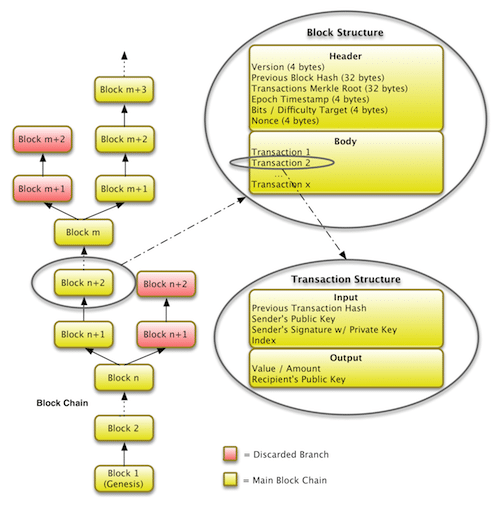

- It is based on the blockchain technology where each block contains the hash of the previous block and forms a continuous chain.

- Each block will include transactions.

- The blocks will have a particular state which is subject to change according to transactions. Eg. if A has 50 bitcoins and wants to send 20 bitcoins to B. Then The new state should show that A has 30 bitcoins left and B has 20 new bitcoins.

- The blockchain must be immutable. It should be possible to add new blocks but the old blocks can’t be tampered with.

- Only valid transactions should be allowed.

- The blockchain should be downloadable and anyone anywhere can easily access and check a particular transaction.

- Transactions could be added quickly to the blockchain if a sufficiently high transaction fee is paid.

There are two pillars of cryptoeconomics as the name itself suggests:

- Cryptography.

- Economics.

Now let’s explore how these two lend the blockchain its unique characteristics.

Cryptography

Blockchain technology uses cryptographical functions for its operations. Let’s looks at some of the main functions that run the blockchain:

- Hashing.

- Signatures.

- Proof of work.

- Zero Knowledge Proofs.

Hashing

In simple terms, hashing means taking an input string of any length and giving out an output of a fixed length. Bitcoin uses SHA-256 to take in an input string of any length and giving an out hash of 256 bits. So what are the applications of hashing in cryptocurrency?

- Cryptographic hash functions.

- Data structures.

- Mining.

Cryptographic hash functions:

A cryptographic hash function has the following properties:

- Deterministic: An input A will always have the same output h(A) no matter how many times you parse it through the same hash function.

- Quick Computation: A function should return a hash of an input as quickly as possible.

- Pre-Image resistance: Given h(A) which is an output of a hash function, it should be infeasible to determine input A.

- Collision resistance: Given two inputs A and B and their hash outputs h(A) and h(B) it should be infeasible for h(A) = h(B).

- Small changes: in the input should drastically affect the output of the hash function.

- Puzzle Friendly: For every hash output Y and an input x. It is infeasible to find a value k, which will result in h(k|x) = Y.

The cryptographic hash functions greatly help with security and mining in the blockchain.

Data Structures:

The two data structures that are important in understanding the blockchain are Linked Lists and Hash Pointers.

- Linked Lists: Linked lists are blocks of data which are connected to one after another. This is an example of a linked list:

Each block in the list is pointing to the other via a pointer.

- Pointer: Pointers are variables which include the addresses of the other variables. So they are variables which are literally pointing towards the other variables.

- Hash Pointers: Hash pointers are basically pointers which not only has the address of other variables but also the hash of the data in that variable. So how does that help in the context of a blockchain?

This is what a blockchain looks like:

The blockchain is basically a linked list where each new block contains a hash pointer which points to the previous block and the hash of all the data in it. Just this one property leads into one of Blockchain’s greatest qualities….its immutability.

How are blockchains immutable?

Suppose in the diagram above someone tries to tamper with the data in block 1. Remember that one of the properties of cryptographic hash functions is that a slight change in the input data will greatly change the output hash.

So, even if someone tries to tamper with the data in block 1 even slightly, it will change its hash drastically which is stored in Block 2. This will, in turn, result in the change of the hash of Block 2 which will result in the change of hash in block 3 and that will keep ongoing on and on till the end of the blockchain. This will freeze up the chain, which is impossible, so just like that, the chain is rendered tamper-proof.

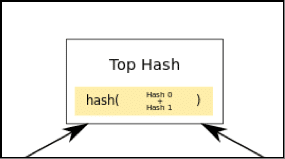

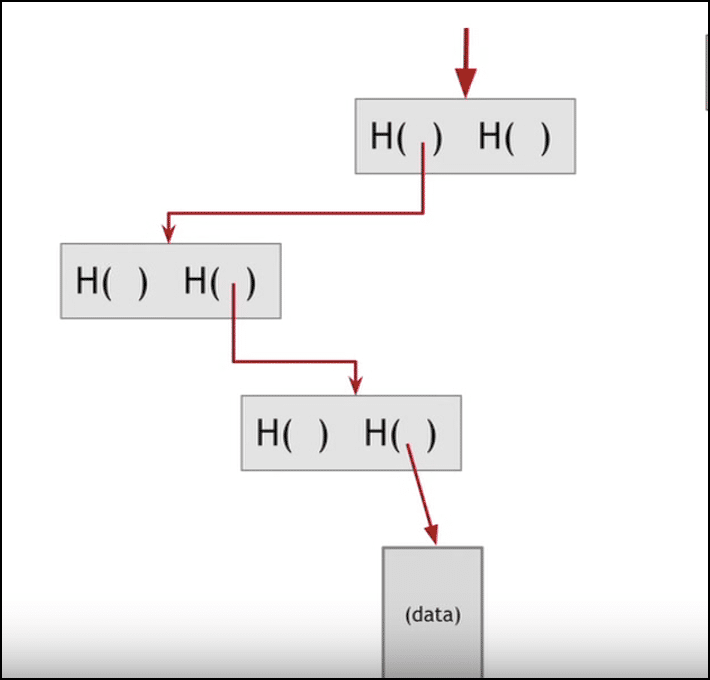

Each block also has its own Merkle Root. Now, as you are already aware, every block has a lot of transactions. If the transactions were to be stored in a linear manner, it will be extremely cumbersome to go through all the transactions just to find a particular one.

This is why we use a Merkle tree.

In a Merkle Tree, all the individual transactions are distilled down into one root via hashing. And this makes traversal very easy. So, if someone were to access a particular data in a block, instead of going through them linearly they can simply traverse using the hashes in the Merkle tree to get to the data:

Mining

Crypto-puzzles are used in order to mine new blocks and for that hashing is critical as well. So the way it works is that there is a difficulty level that is set. After that, a random string called “nonce” is appended to the hash of the new block and hashed again. After that is it checked whether it is less than the difficulty level or not. If it is then the new block is added to the chain and a reward is given to the miner(s) responsible. If it isn’t less than the difficulty, the miners keep changing the nonce and wait for a value which would be less than the difficulty.

As you can see, hashing is a critical part of blockchain and cryptoeconomics.

Signatures

One of the most important cryptographical tools that are used in cryptocurrency is the concept of signatures. What is a signature in real life and what are its properties? Imagine a paper that you have signed with your signature, what should a good signature do?

- It should provide verification. The signature should be able to verify that it is you who actually signed the paper.

- It should be non-forgeable. No one else should be able to forge and copy your signature.

- Non-repudiation. If you have signed something with your signature, then you should not be able to take it back or claim that someone else has done it instead of you.

In the real world, however, no matter how intricate the signature, there are always chances of forgery, and you cannot really verify signatures using simple visual aids, it is very inefficient and non-reliable.

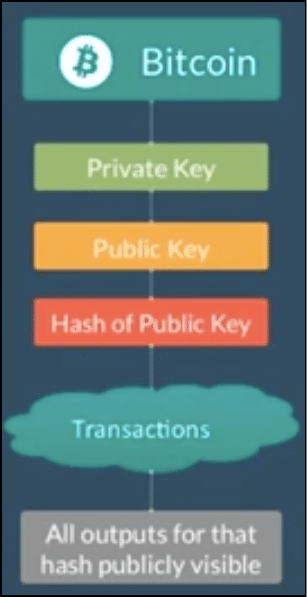

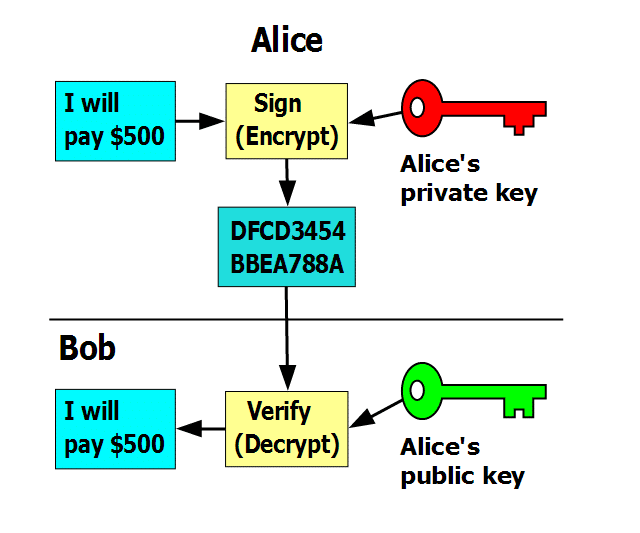

Cryptography gives us a solution using the concept of public and private key. Let’s see how the two keys work and how it fuels the cryptocurrency system. Suppose there are two people, Alan and Tyrone. Alan wants to send some very important data and Tyrone needs to authenticate that the data actually came from Alan. The way they are going to do it is by using Alan’s public and private key.

One important thing to note: It is infeasible to determine one’s public key from one’s private key. The public key is public as the name states, and anyone can have that key. The private key, however, is something that only you should have and you must NOT share it with anyone.

So, let’s go back to Alan and Tyrone if they are to exchange messages using the keys how will it look?

Suppose Alan wants to send a message “m”. Alan has a private key Ka- and a public key Ka+. So when he sends the message the Tyrone he will encrypt his message with his private key so the message becomes Ka-(m). When Tyrone receives the message he can retrieve the message by using Alan’s public key, Ka+(Ka-(m)) and retrieves the original message “m”.

To summarize:

- Alan has a message “m” which he encrypts with his private key Ka- to get encrypted message Ka-(m).

- Tyrone then uses Alan’s public key Ka+ to decrypt the encrypted message Ka+(Ka-(m)) to get the original message “m”.

Check out this diagram for a visual representation:

Verification: If the encrypted message gets decrypted by using Alan’s public key then it verifies 100% beyond proof that Alan was the one who sent the message.

Non-Forgeable: If someone, say, Bob, intercepts the message and sends his own message with his private key, Alan’s public key won’t decrypt it. Alan’s public key can only decrypt messages encrypted with his private key.

Non-Repudiable: Similarly, if Alan says something like, “I didn’t send the message, Bob did” and Tyrone is able to decrypt the message using Alan’s public key, then this shows that Alan is lying. This way he can’t take back the message that he sent and put the blame on anyone else.

Applications in cryptocurrency: Now suppose Alan is sending some transaction “m” to Tyrone. He will first hash his transactions using a hash function. And then encrypt it using his private key. Tyrone knows that he is getting a transaction “m”, so he can then decrypt the message using Alan’s public key and compare the hashes of the of the resulting decryption with the hash of the transaction “m” that he has already. As hash functions are deterministic and will always give the same output to the same input, Tyrone can easily determine that Alan did indeed send that exact same transaction and there was no malpractice involved.

In simpler terms:

- Alan has a transaction “m” and Tyrone knows that he is getting “m” as well.

- Alan hashes m to get h(m).

- Alan encrypts the hash with his private key to get Ka-(h(m)).

- Alan sends the encrypted data to Tyrone,

- Tyrone uses Alan’s public key to decrypt Ka+(Ka-(h(m))) to get the original hash h(m).

- Tyrone can then hash the “m” that he originally had to get h(m).

- If h(m) = h(m), as it should be because hash functions are deterministic, then this means that the transaction was free of malpractice.

Proof Of Work

When miners “mine” to form new blocks to add to the blockchain, the consensus system by which the blocks get approved and added is called “proof-of-work”. Miners use heavy duty computational power to solve cryptographical puzzles to satisfy a difficulty level. This is one of the most path-breaking mechanisms in blockchain technology. Earlier decentralized peer-to-peer digital currency systems used to fail because of something called the “Byzantine General’s Problem”. The proof-of-work consensus system finally provided a solution to this problem.

What is the Byzantine General’s Problem?

Image Courtesy: Medium

Ok so imagine that there is a group of Byzantine generals and they want to attack a city. They are facing two very distinct problems:

- The generals and their armies are very far apart so centralized authority is impossible, which makes coordinated attack very tough.

- The city has a huge army and the only way that they can win is if they all attack at once.

In order to make successful coordination, the armies on the left of the castle send a messenger to the armies on the right of the castle with a message that says “ATTACK WEDNESDAY.” However, suppose the armies on the right are not prepared for the attack and say, “NO. ATTACK FRIDAY” and send back the messenger through the city back to the armies on the left. This is where we face a problem. A number of things can happen to the poor messenger. He could get captured, compromised, killed and replace with another messenger by the city. This would lead to the armies getting tampered information which may result in an uncoordinated attack and defeat.

This has clear references to blockchain as well. The chain is a huge network; how can you possibly trust them? If you were sending someone 4 Ether from your wallet, how would you know for sure that someone in the network isn’t going to tamper with it and change 4 to 40 Ether?

Satoshi Nakamoto was able to bypass the Byzantine General’s problem by inventing the proof of work protocol. This is how it works. Suppose the army on the left want to send a message called “ATTACK MONDAY” to the army on the right, they are going to follow certain steps.

- Firstly, they will append a “nonce” to the original text. The nonce can be any random hexadecimal value.

- After that, they hash the text appended with a nonce and see the result. Suppose, hypothetically speaking, the armies have decided to only share messages which, on hashing, gives a result which starts with 5 zeroes.

- If the hash conditions are satisfied, they will send the messenger with the hash of the message. If not, then they will keep on changing the value of the nonce randomly until they get the desired result. This action is extremely tedious and time-consuming and takes a lot of computation power.

- If the messenger does get caught by the city and the message is tampered with, according to hash function properties, the hash itself will get drastically changed. If the generals on the right side, see that the hashed message is not starting with the required amount of 0s then they can simply call off the attack.

However, there is a possible loophole.

No hash function is 100% collision-free. So what if the city gets the message, tampers with it and then accordingly change the nonce until they get the desired result which has the required number of 0s? This will be extremely time-consuming but it is still possible. To counter this, the generals are going to use strength in numbers.

Suppose, instead of just one general on the left sending messages to one general on the right, there are 3 generals on the left who have to send a message to the ones on the right. In order to do that, they can make their own message and then hash the cumulative message and then append a nonce to the resulting hash and hash it again. This time, they want a message which starts with six 0s.

Obviously, this is going to be extremely time-consuming, but this time, if the messenger does get caught by the city, the amount of time that they will take to tamper the cumulative message and then find the corresponding nonce for the hash will be infinitely more. It may even take years. So, eg. if instead of one messenger, the generals send multiple messengers, by the time the city is even halfway through the computation process they will get attacked and destroyed.

The generals on the right have it pretty easy. All they have to do is to append the message with the correct nonce that will be given to them, hash them, and see whether the hash matches or not. Hashing a string is very easy to do. That, in essence, is the process behind proof-of-work.

- The process of finding the nonce for the appropriate hash target should be extremely difficult and time-consuming.

- However, the process of checking the result to see if no malpractice has been committed should be very simple.

Zero Knowledge Proofs.

What is a zero knowledge proof (zkp)? ZKP basically means that a person A can prove to person B that they have knowledge of a certain piece of information without telling them what that knowledge specifically is. In this example, the person A is the prover and the person B is a verifier. In cryptography, this becomes especially useful because this helps in proving an extra layer of privacy for the prover.

For a ZKP to work it needs to satisfy certain parameters:

- Completeness: If the statement is true then an honest verifier can be convinced of it by an honest prover.

- Soundness: If the prover is is dishonest, they can’t convince the verifier of the soundness of the statement by lying.

- Zero-Knowledge: If the statement is true, the verifier will have no idea what the statement actually is.

An example of a ZKP is the Alibaba cave, let’s see how it works. In this example, the prover (P) is saying to the verifier(V) that they know the password of the secret door at the back of the cave and they want to prove it to the verifier without actually telling them the password. So this is what it looks like:

Image courtesy: Scott Twombly (YouTube channel)

The Prover goes down any of the paths A and B, suppose they initially decide to go through path A and reach the secret door at the back. When they do so, the verifier V comes in at the entrance, with no knowledge of which path the prover actually took and declares that they want to see the prover appear from path B.

In the diagram, as you can see, the prover does indeed appear in path B. But what if this was dumb luck? What if the prover didn’t know the passcode, and took the path B, was stuck at the door and by sheer fortune, the verifier told him to appear from path B, the one they were originally on anyway?

So, to test the validity, the experiment is done multiple times. If the prover can appear at the correct path every single time, it proves to the verifier that the prover indeed knows the password even though the verifier doesn’t know what the password actually is.

What is the application of ZKP in blockchain?

Many blockchain based technologies are using Zk-Snarks, in fact, even Ethereum in its Metropolis phase is planning to bring in Zk-Snarks and add it to its arsenal. Zk-Snarks stands for “Zero-Knowledge Succinct Non-Interactive Argument of Knowledge” and it proves a computational fact about the data without revealing the data itself.

They can be used to generate a proof of statement to verify each and every transaction by just taking a simple snapshot of each transaction which is enough to prove to the receiving side that a transaction was done without revealing the transaction itself.

This achieves two things:

- The integrity and privacy of the transaction is maintained.

- By not revealing the inner workings of the entire transaction the system maintain abstraction which makes it infinitely easier to use.

So these are some of the important cryptographical functions which are being used by the blockchain. Now let us look at the second pillar, Economics.

Economics

Like we mentioned in the beginning, the place where blockchain differs from other decentralized peer-to-peer system is that it gives its users financial and economic incentives to get some work done. Like with any solid economic system, there should be incentives and rewards for people to get work done, similarly, there should be a punishment system for miners who do not act ethically or do not do a good job. We will see how the blockchain incorporates all these basic economic fundamentals.

Must Read: Cryptocurrency Game Theory

There are two sets of incentives that participants in the blockchain have:

Incentive Set #1

- Tokens: The actors who actively participate and contribute to the blockchain get assigned cryptocurrencies for their efforts.

- Privileges: Actors get the decision-making rights which gives them the right to charge rent. Eg. Miners who mine a new block become the temporary dictator of the block and decide which transactions go in. They can charge transaction fees to include transactions within the block itself.

Incentive Set #2

- Rewards: Good participants get a monetary reward or decision-making responsibility for doing well.

- Punishments: Bad participants have to pay a monetary fine or they have their rights taken away for behaving badly

How do cryptocurrencies have value?

Cryptocurrencies have value because of the same reason that money, in general, has value, trust. When people trust a commodity and give it value, it becomes a currency, that’s the same reason why fiat has value and why gold had value in the first place. So when a given commodity is given value, the value changes in accordance with one of the oldest rules in economics, called Supply and Demand.

What is Supply and Demand?

This is the supply-demand graph and one of the most common things that you will see as in economics. As you can see, the demand for the commodity is in an inverse proportion with its supply. The spot where the two graphs meet is the equilibrium i.e. the sweet spot where you want to be. So, let’s use this logic for cryptocurrency and, in general, bitcoin.

The supply of bitcoins is fixed at 21 million. That’s the market cap on all bitcoins. Since the total number is fixed there are several things that need to be considered when it comes to the supply of bitcoin. Because of this, certain regulations need to be made to make sure that bitcoins become progressively harder to mine. If these steps are not taken, the miners will mine indiscriminately, pumping out the remaining bitcoins and putting it in the market, decreasing its overall worth.

In order to make sure that miners don’t pump out all the bitcoins at once the following steps are taken:

- A new block is added to the chain only at the interval of 10 mins which leads to a reward of 25 bitcoins. The time has to be fixed to make sure that miners don’t just keep adding blocks to the chain with no regulations.

- The second thing that the bitcoin protocol does is that it constantly increases the difficulty level. As explained above, during the mining process the hash of the block along with the nonce needs to be less than a particular number. This number is called the “difficulty level” and usually begins with a number of zeroes. As the difficulty increases the number of zeroes increases as well.

With these two factors and the fact that mining has become a lot more specialized process which includes humongous investment, the entire process makes sure that the supply of bitcoins in the market is kept at check. And this is true for all cryptocurrencies, using proof of work, as well.

The Demand of the cryptocurrency depends on a lot of factors:

- What is the history of the currency?

- Has it been subject to a hack lately?

- Does it consistently generate results?

- How good is the team behind it?

- Does it have potential to become better?

- How much is the hype around it?

All these factors determine how “hot” the currency is and as a result, the value shifts depending on its demand.

The Game theory in blockchain

So how does an unregulated, decentralized peer to peer system remain honest? Miners have a lot of power and they can easily commit crimes and get away with it. This is where all the previous attempts at a decentralized system failed, users are humans and humans are prone to “bad” behavior. So how do you keep a decentralized system of humans honest? The answer lies in one of the most fundamental economic ideas: Game Theory.

Game theory is basically the study of strategic decision-making. Making decisions which make the most sense to you, keeping in mind the decision of the competitors is basically what game theory is all about. One of the most fundamental concepts of game theory is the “Nash Equilibrium”.

What is Nash Equilibrium?

A Nash Equilibrium is a state where a party takes the most optimal strategy keeping in mind the actions of the other party and they can’t gain anything by changing around their strategy. Let’s see an example of the Nash Equilibrium in action.

Now consider the above table that we call a “Payoff Matrix”. The numbers are units of payoffs that a person will get upon taking (or not taking an action). So let’s analyze:

If A Takes Action:

Then B has a payoff of 4 if it takes action and 0 payoff if it doesn’t take action. So the optimal strategy for B is to take action.

If A Doesn’t take Action:

Once again, B has 0 payoffs for not taking action and a payoff of 4 if it does take action.

So we can conclude that regardless of what A does, B’s best strategy lies in taking action. Now, similarly, let’s checkout the what is the best strategy for A.

If B takes Action:

A has a payoff of 0 for not taking action and a payoff of 4 for taking action. So the best way for A is to take action.

If B doesn’t take Action:

A has a payoff of 0 for not taking action and a payoff of 4 for taking action.

So, regardless of what B does, A’s the best way forward is to take action.

We can hence conclude that for both A and B the best way to go ahead is to take action.

Hence the Nash Equilibrium is:

When both of them take action.

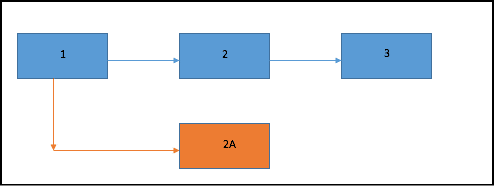

Now, what is the application of the Nash Equilibrium in the blockchain? Well, it won’t be a stretch to say that the blockchain exists and the miners remain honest BECAUSE the chain itself is in a self-imposing Nash Equilibrium.

Let’s take an example:

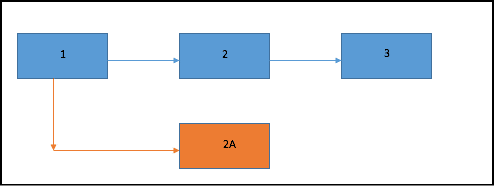

Consider the above blockchain. The blue blocks 1,2 and 3 are part of the main chain. Now suppose a malicious miner mines a block 2A and is attempting a hardfork for his own financial gains. What is stopping the other miners from joining him and mining on the new block?

Well, the miners have a very hard and fast rule, any block that is mined on an invalid block is not considered a valid block. So, the other miners will simply ignore the invalid block and keep mining on the old chain anyway. Remember, all currency works on trust and perceived value, so the currency that the malicious miner may mine from the new block will not be considered of any value at all. And remember, mining is a very expensive process, so why will anyone waste so much resource on a block that may or may not even be considered valid?

Now you may be thinking, what if a lot of miners decide to join the new miner and mine on the new block? The problem with that is that the blockchain network is a huge and widely distributed network wherein communication and coordination is next to impossible. Keeping that in mind, a coordinated attack like that on the blockchain is infeasible. Most miners will simply choose the route where they get a maximum payoff, and this way the Nash Equilibrium of the main chain is maintained.

Punishment in the blockchain

Like with any efficient economic systems, good actions should be rewarded and negative actions should be punished. How does punishment work in a game theory model? Imagine a payoff matrix where the payoff for the participants is high but the implication on the society, in general, is very high. Eg.

Suppose there are two people A and B and they are both about to commit a crime. Now according to the matrix, the payoff for both of them is high when they commit a crime so their Nash Equilibrium lies in both committing a crime. Now while this does make sense logically, the implications on the society, in general, is very bad. Humans, more of than not, are motivated by personal greed and not everyone is altruistic. If this were to hold true, the world will be a terrible place to live in. So, how did humans counteract this? By introducing the concept of punishment.

Suppose we have a system where for every -0.5 of utility taken for them public, there will be a punishment factor of -5 on everyone who commits a crime. So, let’s add the punishment factor on the payoff matrix above and see how that changes the table:

As you can see above, the payoffs change drastically and the Nash Equilibrium changes to (1,1), as in both don’t commit a crime. Now, punishment is expensive, a utility of -0.5 is taken from the society after all. So what is the incentive for society to join the punishment game? The way this question was answered was by making punishment mandatory for everyone i.e. anyone who is not participating in the punishment game is punished as well. An example of this is a tax-driven police force. The police can punish the perpetrators but a utility in the form of tax is taken from the public. Anyone who doesn’t pay the tax and participate in the game is considered a criminal themselves and punished accordingly.

In a blockchain, any miners who are not following the rules and mining illegal blocks are punished by having their privileges taken away and risk social ostracization. The punishment becomes even more severe when proof-of-stake is involved (more on this later). By using simple game theory and punishment system, the miners are kept honest.

More incentives for miners

When a miner(s) successfully mines a block, they become the temporary dictator of that block. It is completely their jurisdiction as to which transactions go in the block and the speed of the said transactions. For the transactions to be included, they can charge a transaction fee. This incentivizes the miners because they get additional financial rewards OVER the reward they gain from mining a new block anyway (25 BTC in bitcoin and 5 Eth in Ethereum).

In order to make the system fair and to make sure that not the same miners get to mine new blocks and collect the rewards every single time, the mining difficulty level is adjusted periodically. This makes sure that the miners who get to mine a new block is completely random. Over the long run, mining is a zero sum gain, in other words, the profits that a miner gets from mining a new block eventually gets adjusted because of the costs of mining.

P+Epsilon Attack

A proof of work system, however, is vulnerable to a particular type of attack called the “P+ epsilon attack”. In order to understand how this attack works we must define some terms beforehand.

Un-Coordinated Choice Model: An uncoordinated choice model is a model where all the participants don’t have the incentive to work with one another. The participants may form groups but at no time is the group big enough to become a majority.

Coordinated choice model: This is a model where all the participants coordinate because of a common incentive.

Now it is assumed that the blockchain is an uncoordinated model, but what if there is an incentive for the miners to do an action which goes against the integrity of the blockchain? What if there is a bribe involved to make the miners take a particular action? This is where the bribing attacker model comes in.

What is the bribing attacker model?

Imagine an uncoordinated model. Now, what if an attacker enters the system and incentivizes the miners to coordinate with each other after giving them a bribe? This new model is called a bribing attacker model. In order to successfully bribe the system, the attacker must have two resources:

- Budget: The total amount of money that the attacker has that they are willing to pay to make the miners take a particular action.

- Cost: The price that the miner actually ends up paying.

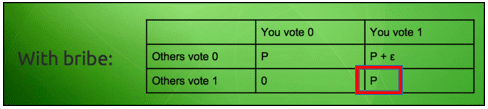

However, if an attacker does decide to attack the blockchain, we arrive in an interesting conundrum… and this is where the “p + epsilon attack” comes in. For reference check out this table:

Image courtesy: Vitalik Buterin Presentation.

Imagine a simple game such as an election. If the people vote for a particular person if they vote the same way everyone is voting, then they get a payoff but otherwise, they don’t. Now imagine, that a briber enters the system and lays down this condition to an individual. If you vote AND the others don’t vote, then you will get a payoff of “P + ε”. The usual payoff AND an extra bribe of ε on top of that.

So now, the payoff matrix looks like this:

Image courtesy: Vitalik Buterin Presentation.

Now imagine this scenario, everyone involved in this game gets to know that if they vote anyway, then there is a chance that they may get a payoff, but if they don’t vote then there is a 50-50 chance of them getting a payoff.

What do you think the players will do then? Of course, they are going to vote to get a guaranteed payoff. Now, this is where things get interesting. As can be seen in the matrix, the briber only has to pay the bribe “ε” when only person votes while the others don’t. However, in this situation, since everyone is voting, the Nash equilibrium shifts to:

That’s right, the briber didn’t even need to pay the bribe!

So, let’s approach this problem from the POV of the briber:

- Convince the group to vote a particular way.

- Achieve the goal without even having to pay the bribe.

It is a huge win-win scenario for the briber and this has heavy implication on the blockchain especially in a proof-of-work system. Let’s check out our old hypothetical blockchain again:

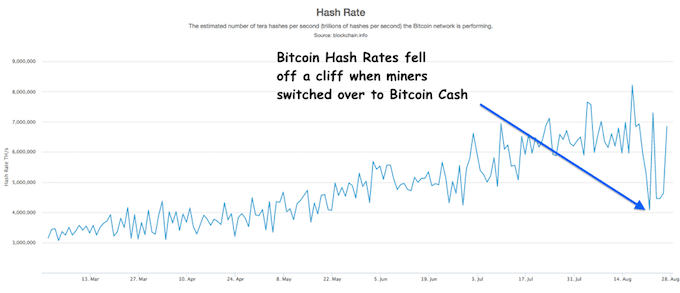

Suppose the briber really wants the chain to hardfork and declares that a group of miner who opts to join the new chain will get a bribe of ε, this will incentivize the entire miner community to coordinate and join the new chain. Obviously the bribe has to be extremely high for something like this to happen, but as we have seen in the briber attacker model above, the attacker won’t even need to pay the said amount. According to Vitalik Buterin, this is one of the biggest problems of the proof of work system, its vulnerability to the P + epsilon attack.

The solution lies in proof of stake.

The solution to this form of incentive driven attack lies in proof of stake. In this system, the miners have to put up a portion of their personal fortune and invest it in future blocks. As an economic system, this is much better because the punishment in it is way more severe. Instead of having their rights taken and getting away with a “tap to their knuckles”, miners now face the very real possibility of their stake and fortune being taken away.

So, how does this help in preventing P + epsilon attacks? Put yourselves in a miner’s shoes. You have a part of your fortune invested inside a block which is to be added in the main chain. Now a briber comes and tells you that you can get an extra payoff if you make your block join the main chain. BUT, if the chain doesn’t get approved then there is a huge risk of you losing all the money that you have invested in the block. Plus, as the P + Epsilon attack states, you won’t even get the extra payoff from the bribe. For a miner, once that they have invested a stake, it is a no brainer for them to continue in the main chain and not to get involved in any malicious activities.

Conclusion

So as you can see, cryptography and economics have combined in a very beautiful and intricate manner to create the blockchain technology. The growth that it has experienced over the last few years is staggering and it is only going to get better and more widely used.

ICO Basics, To Invest or Not? Cutting Through The Bullshit

ICO Basics, To Invest or Not? Cutting Through The Bullshit. There are many terms associated with the cryptocurrency world that has become, more or less, very mainstream over the last 4-5 years. Everyone has an idea about what a “blockchain” is and people definitely know what a “bitcoin” is.

Lately, however, one term has been gaining more and more mainstream attention. That term is “ICO” or Initial Coin Offerings and has raised OVER $1.3 Billion for blockchain based start ups. It has been called everything from “revolutionary” to “a Ponzi scheme. Before we get into the meat of this, we need to understand everything that surrounds this astounding phenomenon.

The origins of ICO

In the real world, companies can always secure funds by approaching angel investors and venture capitalists but by doing that, they would have to give away a share of their equity to them. What companies wanted, was to get a lot of funds without giving away equity and ownership. The only way that they could do that was by going public.

The way companies do this is by holding an IPO aka Initial Public Offering. How does an IPO work?

In an IPO a private company basically decides to put up its private shares up for sale to the general public. Anyone anywhere can buy the shares of the company. Initially, these shares are dirt cheap and if the company hits it big then there is a chance of your shares ballooning up to exorbitant prices. We have all heard stories of the masseuse who became a multi-millionaire after her 500 “useless” stocks in Google matured over time.

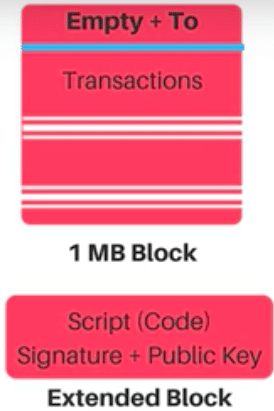

So, people started wondering what would happen if we used the same concept and put it on a blockchain based environment. This is what gave birth to the concept of ICOs. ICOs are pretty similar to IPOs but with 3 major differences.

Firstly, the ICO was decentralized with no central authority, secondly, the ICOs lacked the tedious red tape that most IPOs were bogged down by and finally, they were unregulated while IPOs have always under been heavy regulation. Now there was a problem that blockchain based companies were facing when it came to ICOs. In an IPO, the investors got shares in return of their investment. What would a blockchain based company give away in exchange of capital? They had to invent the blockchain equivalent of a share and that was when they came up with the idea of “Tokens”.

What is a Token?

An ICO is a sort of mixture of an IPO and a crowd-sale. When you are interested in a particular project in the blockchain, the way you can gain access to it is by sending the developing team some amount of money, which is usually paid in Bitcoin or Ethereum and getting the equivalent amount of tokens in return.

Tokens have gained even more prominence since the advent of Ethereum. Ethereum provides a platform where you can use the blockchain technology not just for making currency, but to make decentralized applications (DAPPS) as well. If you want to use these DAPPS then you will need the tokens that are native to its respective environment. There are two categories that all tokens fall under:

- Usage Tokens.

- Work Tokens.

Usage Tokens: These are tokens that act as native currency in their particular environment and can be exchanged for other tokens or FIAT money. Ether is a great example of a usage token. In short, usage token is a currency.

Work Token: Not all tokens, however, act as currency. Some tokens are there to give you various rights within their native environment. Eg. If you were a DAO token holder, then you had the right to vote on whether a particular DAPP could get funding from the DAO or not.

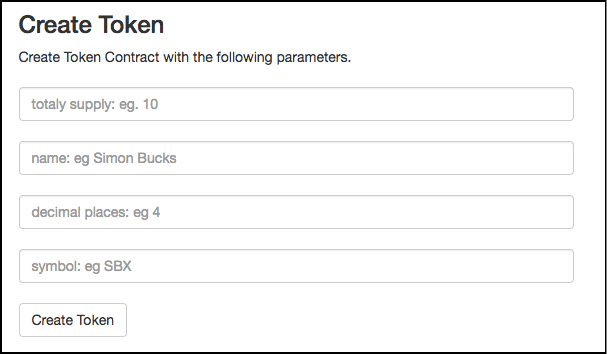

How do you make a token?

Making a token is deceptively simple. By far the easiest method is to go on Token Factory and fill up the following fields:

Firstly, you will have to determine the total supply. You don’t want a humongous amount of tokens available, that will kill their value.

Then you have the name field. Give your tokens any name you want. Make it sounds professional though if you want a good and profitable ICO.

Determine how many decimals places the value of your tokens will go to.

And finally, decide on a symbol for your token! It is that simple.

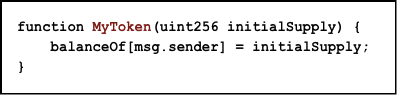

Now., if you are one of those DIY types who would prefer coding their tokens then that is a possibility as well. If you are making a DAPP in Ethereum you can simply use the solidity code to create your own token contract. This is what a simple token contract looks like:

The block of code is divided into 3 parts:

- The Mapping.

- Giving the creator all the tokens.

- Transfer the sender the requisite amount of tokens for the ether.

Now we will go into the code and understand what is exactly happening and how it is working. It may appear complicated on the surface but once you go deep into it, you will see how simple and easy to understand it is.

The Mapping:

Ethereum, like all cryptocurrency, is an open ledger. So it makes sense that all token made on an Ethereum contract will be registered on an open database clear for everyone to see. The mapping function makes sure of that.

The creator getting all the tokens:

When all the tokens are created, the entire supply goes to the contract creator who can then send the tokens to anyone who funds the project with ETH.

The Transfer:

The last part of the code is the transfer.

You will give your tokens an initial value and based on the amount of ETH that you are getting paid by the sender, they will get the requisite amount of tokens. The same number of tokens will cut from your balance and it will be added to the sender’s balance.

As you may have already guessed, there are thousands of tokens out there, and while that’s a good thing, there is also a major flaw that needed to be addressed. Think about this, if everyone designed their own tokens giving it their own unique twist, it will be an absolute horror show to save them in a wallet. Many times you will have to follow elaborate and needlessly complicated steps just to store your tokens in a wallet. That would have been a nightmare. What was needed was a standard or a basic blueprint for all tokens to follow. Fabian Vogelstellar, one of the founders of the Mist Wallet came up with the solution with his ERC20 token standards.

What is the ERC20 Token Standard?

The ERC20 standards have been put in place so that all Ethereum tokens follow a particular rule and standard. While this is not an enforced rule, most DAPP developers are encouraged to follow the standards to ensure that their tokens can undergo interactions with various wallets, exchanges and smart contracts without any issues.

These standards also helped others gain an idea of how future tokens are expected to behave. ERC20 tokens have gotten widespread approval and most of the DAPPS sold on ICO’s have tokens based on the ERC20 standard. So what are these standards?

They are basically a set of 6 functions which, when executed, do the following 4 activities:

- Get the total token supply.

- Get the account balance.

- Transfer the token from one account to another.

- Approve the use of the token as a monetary asset.

How does an ICO work?

So now that you have gotten a crash course on what tokens are and how they work, let’s do a deep dive on ICOs and why, for better or for worse, people are calling it the new “Gold Rush”. A number of millionaires that ICOs have made in the last year or so is staggering. Check out this graph:

Check out this graph:

Over the past 12 months, have raised over $600 million as opposed to $140.30 million by established Venture Capitals. That is mind-boggling! So what is it about ICOs that has attracted so many investors? ICO is the rockstar of the investment world, it is the untamed wild genius wearing a torn t-shirt and baggy jeans, living among a group of suit-wearing snooty businessmen. There is something extremely seductive about the concept.

Think about this, anyone, with an idea for a project, can gain massive financial backing from a community without being bogged down by politics or endless red tape. The idea that anyone anywhere can get the financial backing they need in an unregulated manner was a welcome idea for all. No longer will investments be reserved just for the uber-rich, anyone can gain the funds to make their dreams a reality.

The exact procedure behind an ICO can be broken down into the following steps.

Firstly, the developers will announce their intention of making the project to generate hype and interest in the project. This step is very important because first impressions are everything.

Then, the developers will create a white paper. A white paper is a document issued by the developers which highlight their project and the specific features of that project that makes it enticing for the potential investors. While it is true that white papers are supposed to be a sales and marketing tool, it is nowhere near as flashy and over-the-top as a brochure or a sales letter. Whitepapers are written in an academic manner and the specific purpose is to entice the investors by showing its potential and features. They are at least 2500 words long and are meant to be purely informational.

After that, they will run the white paper through prominent members in the blockchain community to get their backing. Getting this backing is critical because this is where they will gain the credibility required to carry forward with the project.

Now, they will need to create the tokens which they are going to exchange for Bitcoin or ETH in the token sale. The process of token creation has already been covered above. Developers will have to decide the limit to the number of tokens and the amount that they want to charge for each token. Usually, the price of these tokens is very low at the start of the ICO. Setting a cap on the number of tokens is necessary because having a limited supply of tokens automatically increases their demand (according to the law of supply and demand).

Along with the cap on the number of tokens issued, developers will have to decide a time at which they want to hold their ICO. Selecting the time, and the amount of time it runs for is CRITICAL and this will be covered in detail later on. Along with that they also need to decide on the cap for the amount of money they will be taking in.

Once all these are decided, the developers choose a platform where they can advertise their ICO. Earlier it used to be tough to do so because developers had to convince people to come to their websites to gain more information about the ICO. But now, there are a number of websites which provide the platform for developers to address this particular need. Some of the best ones are:

- Waves.

- ICONOMI.

- State of DAPPS (for Ethereum Tokens only).

- TokenMarket.

Think of these websites as Kickstarter or Indiegogo of the crypto world. Once the ICO has been advertised the developers can then actually do the ICO.

For a visual representation of how an ICO works:

Investors send the coins to the public address of the developers and in exchange, they get tokens in return.

So to summarize:

- Firstly, the developers declare their intention of making the project.

- Then, the project developers create a white paper which includes the details of their project explained in a descriptive way.

- They get the backing and confidence from certain prominent members in the cryptocurrency world who act as “advisors”.

- They then create the tokens and decide on various caps such as a token cap, money cap, and time cap.

- Advertise the ICO using one of the platforms mentioned above.

- Hold the ICO.

In the broad spectrum of things there are two different kinds of ICOs:

- Currency ICO.

- Project ICO

Currency ICO

A currency ICO is when developers bring in a new currency system. The developers give out tokens which become new cryptocurrencies in exchange of the older more established coins such as Bitcoin and Ethereum. The reason why people are drawn to these ICOs are that of investment opportunities. One of the best examples of these kinds of ICOs is the Ethereum ICO.

In later 2013, a young programmer named Vitalik Buterin was working for Bitcoin as a developer and was getting increasingly frustrated. He realized that the blockchain technology had more potential than being a mere currency system. His vision was to make an alternate form of the internet. This vision was Ethereum, a platform where people not only will have access to a new form of currency (Ether) but they will also be able to create and develop a newer form of DAPPS on the platform itself.

The Ethereum ICO lasted for 42 days and went on from July-August 2014 and raised >$18 million. Back then it was the biggest crowdfunding even in human history. The early birds got a humongous ROI. In the beginning, if you invested just 1 BTC you would get 2000 ether in return. The current valuation of those 2000 ether is ~$420,000. Not bad for a $2500 investment! But more than the ROI the biggest thing that makes this particular ICO so important in crypto history is the concept of the project itself.

If you want an advertisement for why ICOs are so important, just read up on the Ethereum ICO. This was one man with a vision who got a dedicated and talented team around him, got the white paper out, convinced people to invest in his project and then ultimately made one of the most important platforms in crypto history. This is what ICOs should be like.

Project ICO

Along with the currency ICO we have the project ICOs which issue “work tokens”. When you buy these tokens in the crowd sale you gain certain rights and votes inside the environment of the DAPP itself. One of the most famous, and consequently, infamous examples of this kind of ICO is the DAO.